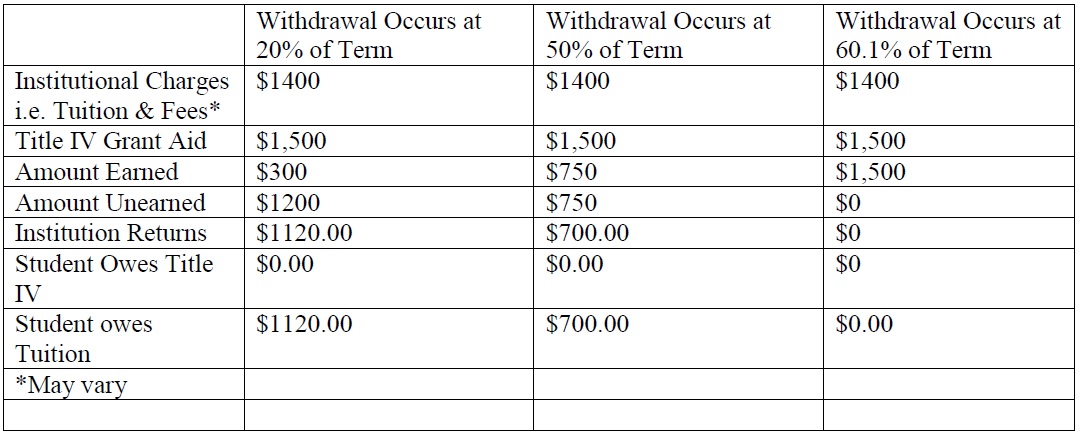

a. The percentage is calculated by dividing the number of days completed in the quarter by the number of calendar days in the quarter (through the 60% of the quarter). The calendar days include weekends and exclude breaks of at least 5 consecutive days. That represents the percentage of “earned aid.” The percentage of the quarter the student did not attend represents the percentage of “unearned aid.” The maximum grant overpayment cannot exceed half of the total Title IV grant funds received by the student.

b. SPSCC returns to the federal aid programs the amount of unearned aid up to the total institutional charges incurred by the student (tuition and fees).

c. SPSCC must return unearned funds for which it is responsible as soon as possible but no later than 45 days after the date of determination of a student’s withdrawal.

d. The student returns (repays) the balance of the unearned funds to SPSCC which is then returned to the federal aid programs (see Repayment section).

e. Any student that owes a repayment of funds will be notified as soon as possible following the Determination Date, but no later than 45 days.

f. SPSCC must return unearned funds for which it is responsible as soon as possible but no later than 45 days after the date of determination of a student’s withdrawal.

- Unsubsidized Federal Stafford Loan – repaid in accordance with terms of promissory note

- Subsidized Federal Stafford Loan – repaid in accordance with terms of promissory note

- Pell Grant

- Federal Supplemental Education Opportunity Grant (SEOG)

- Washington State Need Grant

- Institutional Aid

Note: Per our Satisfactory Academic Progress Policy, students who are determined to owe a repayment will not be eligible for financial aid until all funds have been repaid in full.

Note: For information concerning the exact date of the 60% point for determining whether an R2T4 repayment will result please, contact the financial aid office on our main campus.